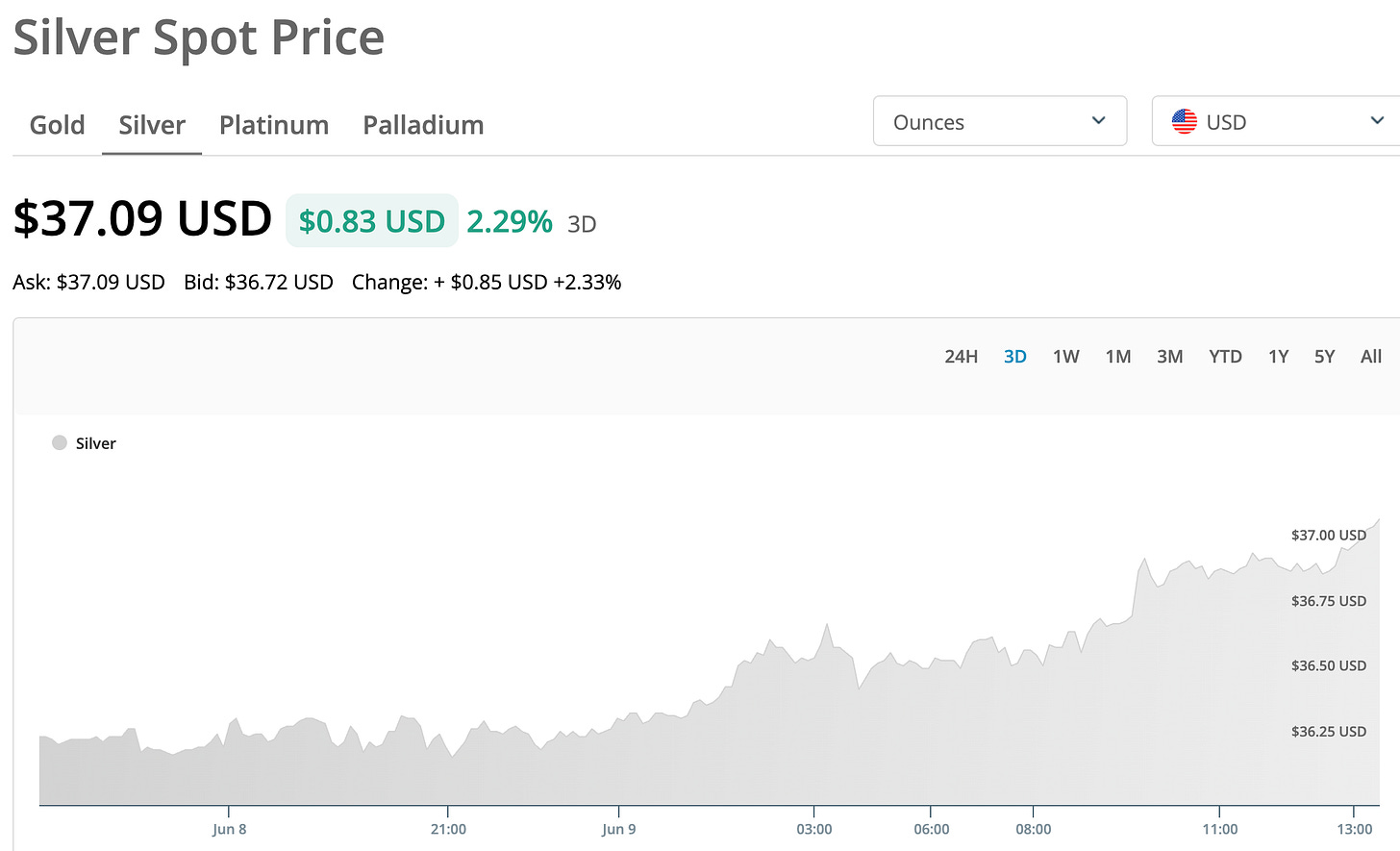

$37 Silver is Here: Up 12% for the week, 23% in 2025, 111% in 5 years

Silver is trading at its highest level in over 13 years, reaching around $37.09 per ounce—the strongest since early February 2012. Analysts are saying there’s more in store as the price of mining silver continues to click up with inflation.

“Silver breaching the $37 mark is more than just a technical milestone—it’s a signal that the industrial and monetary forces behind this rally are finally being priced in,” said Elena Marquez, senior metals strategist at Si Iver.

“With demand from solar and EV sectors accelerating and supply lagging, we believe silver could challenge $42 before the end of the year.”

Key Drivers Behind the Surge

Fundamental Supply Shortages

Silver has been in a structural deficit for the fifth consecutive year. Since most silver is mined as a by‑product of base metals, higher prices haven't yet triggered a significant supply response.Industrial & Green Energy Demand

Demand from photovoltaic panels, electric vehicles, medical equipment, and robotics is intensifying. In the UK, mandates requiring solar panels on new homes are accelerating this industrial squeeze.Macro & Monetary Trends

A softer U.S. dollar and declining bond yields are boosting silver's appeal, especially as gold flattens near $3,310/oz.Inflation & Rate Speculation

With upcoming CPI data and speculation on Federal Reserve rate cuts, metal markets are anticipating a shift toward tangible assets .Technical Breakouts

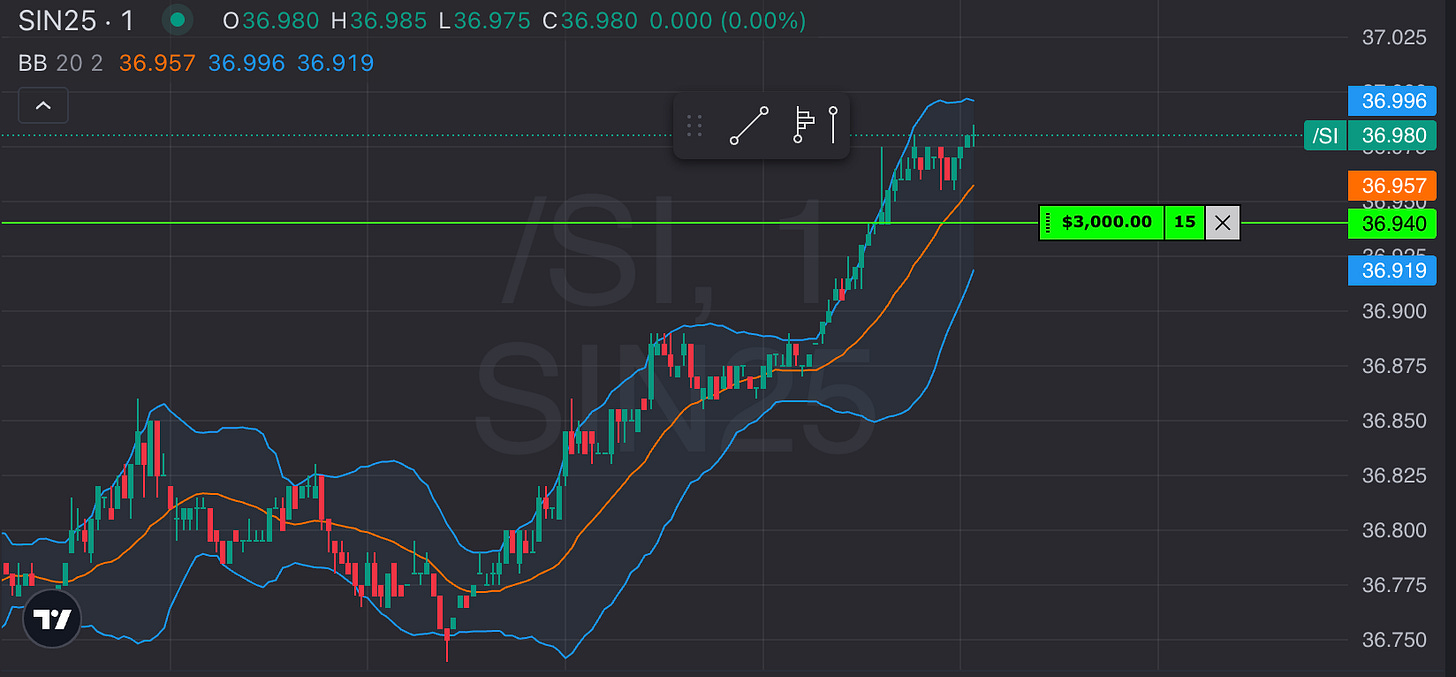

Technical analysts highlight silver clearing key resistance levels around $34.50–$36.25, supported by bullish momentum indicators and a rising EMA‑50.

💰 Forecasts & Sentiment

Short-term outlook: Bulls are targeting $37.00 and potentially $38 per ounce in the immediate term.

Mid-term projections:

Mainstream analysts see potential to $40–$50/oz amid sustained supply constraints.

Risks to consider: As a historically volatile asset, silver lacks deep liquidity; any interest rate shift or demand drop could trigger sharp reversals.

🏦 Investment Channels

Physical bullion & coins: Silver bars, rounds, and sovereign coins (e.g., American Silver Eagle, Canadian Maple Leaf).

Exchange-traded products: ETFs like SLV (recently trading around $33.46) offer convenient market access without storage hassle.

Futures & derivatives: CME’s COMEX futures (e.g., SIc1) are trading near 52‑week highs (~$36.96)

🧭 Why $37.09 Matters

Trading near $37/oz puts silver within striking distance of a multi-year breakout. Stimulated by stronger industrial usage and easy monetary conditions, the metal is testing psychological resistance. Whether driven by macro policy or green‑energy demand, today’s $37.09 level marks a crucial inflection point.

🔍 Summary Table

Theme Context Supply–Demand Structural deficit; mining sluggish to scale due to by-product nature Industrial Demand Renewable energy, medical uses, and tech fueling sustained demand Macro Environment Weak dollar, low yields, rate cut expectations favor silver Technical Setup Breaking key zones; bulls eyeing $38+ momentum continuation Analyst Views Targets range from $40–$50. Frontrunner voices foresee up to $70/oz Risks Volatility and liquidity concerns; macro surprises could pressure price

Outlook & Strategy

Short-Term (Weeks):

A close above $38/oz could spark a mini‑squeeze, potentially challenging $40.

Support lies near $36, then the larger pivot at $35.

Medium-Term (Months):

$40–$50 appears plausible if supply shortages and industrial trends persist.

Realizing Kiyosaki’s $70/oz target depends on broader monetary expansion.

Considerations for Investors:

Decide between physical vs. paper exposure based on liquidity, fees, and storage needs.

Monitor CPI, Fed communications, and base metal production reports.

Use technical entry points confirmed by EMA and RSI signals; apply risk management tools like stop-losses.

“We’ve been in a stealth silver bull market for over a year, but this move makes it impossible to ignore,” noted David Ngoma, commodities analyst at Si Iver.

“Silver’s scarcity, coupled with its dual role as both an industrial input and a financial hedge, is creating a perfect storm for long-term upside.”

Final Take

Silver’s climb to $37.09/oz reflects a broader transformation: industrial innovation, monetary shifts, geopolitics, and technical momentum all converging. Whether you're drawn to its role as a safe haven, an industrial staple, or a speculative lever, today’s level is a powerful signal. The next weeks will be critical in determining if it breaks into a sustained bull market—or retraces to test its strength.

We offer silver on layaway (put down 15% to control up to 1,000 oz of silver) with price protection through our hedging strategy.

One of our customers put 15% down when silver was $32 and now has locked in a profit now that silver is at $37. His profit is now more than the 15% he put down.

Pay securely by credit card—and if you're not satisfied, you're covered by chargeback protection. We’re here to serve you as a member of the silver stacker community.