Silver in 2025: High Demand, Low Supply, Strong Potential

Silver's 2025 growth is driven by strong industrial demand, supply shortages, and its role in green tech, making it a solid investment opportunity.

Silver’s Strength as an Investment

Silver has shown steady growth and resilience in 2025, making it an attractive option for investors. Currently priced around $32.25 per ounce, the metal has gained value since the start of the year. This rise is fueled by strong industrial demand, supply shortages, and broader economic trends that continue to highlight silver’s investment potential.

Why Silver Demand is Growing

One of the biggest reasons silver is holding strong is its increasing use in green technology. Silver is essential for making solar panels and electric vehicles (EVs) because of its unmatched ability to conduct electricity. In 2025, industrial demand for silver is expected to grow by 3%, surpassing 700 million ounces for the first time. With record-breaking solar panel installations and the growing EV market, the need for silver isn’t slowing down anytime soon.

Silver Supply is Struggling to Keep Up

Even though global silver supply is expected to hit an 11-year high of 1.05 billion ounces in 2025, there’s still a major supply gap. The market is projected to face a shortfall of 149 million ounces, marking the fifth straight year of supply deficits. One of the main reasons for this is that silver is often mined as a byproduct of other metals like copper and lead. Since those metals aren’t seeing big price increases, mining companies aren’t ramping up production, keeping silver supply tight.

With strong demand and ongoing supply constraints, silver remains an intriguing investment, whether you're looking at it for long-term growth or as a hedge against economic uncertainty.

With new tariff policies expected under President Donald Trump's administration, there’s a lot of uncertainty in the market. When the economy feels shaky, investors tend to flock to safe-haven assets like precious metals, which has helped support silver prices. In fact, since late 2024, more silver has been moving into CME warehouses, signaling stronger demand.

Another key factor to watch is the gold-to-silver ratio, which currently sits at 91. This means it takes 91 ounces of silver to equal the value of one ounce of gold—historically, this ratio has usually been between 40 and 70. If silver starts catching up to gold, there could be significant room for growth in its price.

Investor Sentiment and Market Outlook

Investor confidence in silver remains robust, with a survey from late 2024 revealing that nearly half of retail traders anticipate silver prices to surpass $40 per ounce in 2025. This optimism is driven by silver's dual role as both a critical industrial metal and a dependable store of value, positioning it as a compelling option for portfolio diversification.

The silver market is projected to experience a significant deficit for the fifth consecutive year in 2025, with industrial demand expected to reach record levels. This persistent supply-demand imbalance, coupled with favorable macroeconomic conditions, enhances silver's appeal as an investment opportunity.

The cost to mine silver varies among producers due to factors like ore grade, mining methods, and regional conditions.

However, a typical breakdown to estimate the mining cost considerations:

Extraction Costs: The cost of extracting the silver from the earth (which could include drilling, blasting, and removing the ore from the mine).

Processing Costs: The cost to refine the silver ore into pure silver, which might include smelting and chemical treatments.

Labor and Equipment Costs: Wages for workers, machinery, and maintenance costs.

Environmental Costs: Costs associated with ensuring the operation complies with environmental regulations.

Royalties and Taxes: Payments made to governments, landowners, or other stakeholders.

It's important to note that these costs can fluctuate with changes in silver prices. For instance, when silver prices were around $24 per ounce, many mines had all-in sustaining costs (AISC) between $21 and $23 per ounce. As silver prices fell to $20 or $17 per ounce, mining costs adjusted accordingly.

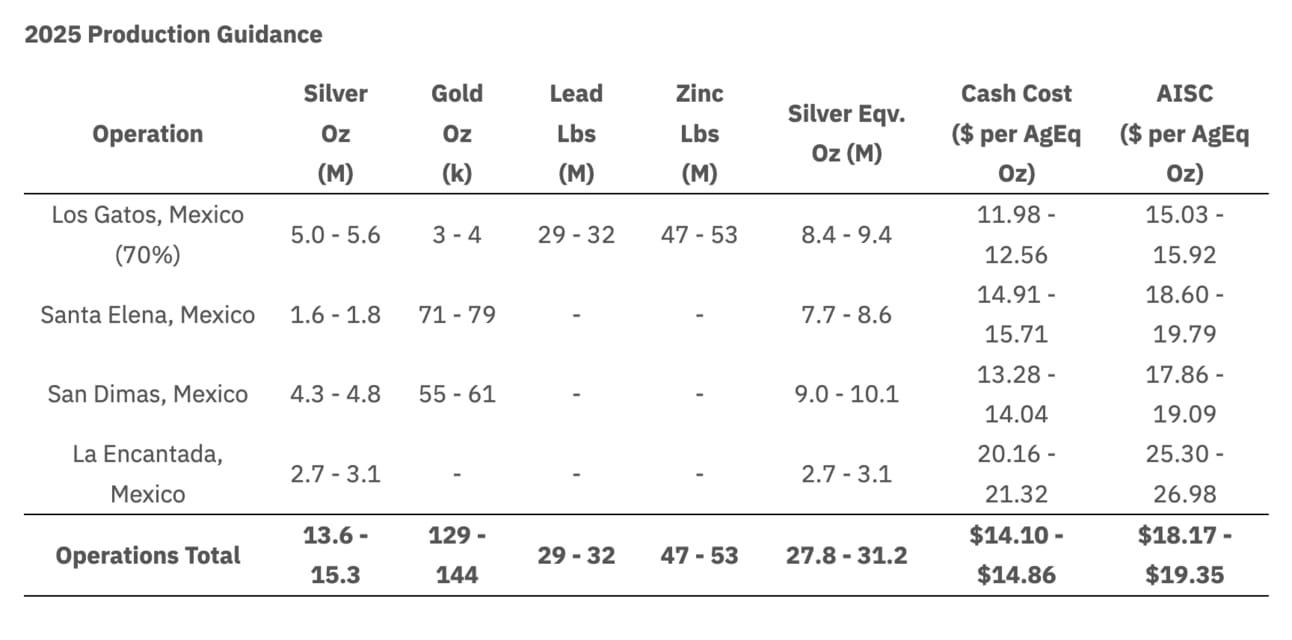

Here are First Majestic Silver Corp’s 2025 numbers.

Stock enthusiasts often say that precious metals don’t pay dividends, but that’s not entirely true. One strategy is to sell covered calls—this could involve selling the right for an investment to capture all profits on silver above $35.50 for the next year.

Statistically, writing options can be a smart move because, more often than not, silver doesn't rise as quickly as optimists expect, providing you with a steady stream of income.

To estimate the price of an at-the-money (ATM) silver option and a 10% out-of-the-money (OTM) silver option that expires in 1 year at an implied volatility of around 25-30%, we need to use the Black-Scholes model. Implied volatility (IV) represents the market's expectation of how much an asset's price will fluctuate in the future.

Given Data:

Current Silver Price (Spot Price, S): ~$32.25

Time to Expiration (T): 1 year

Implied Volatility (IV): ~25%-30%

Strike Price (K) for ATM: ~$32.25

Strike Price (K) for 10% OTM: ~$35.50 (approx. 10% above spot)

Risk-Free Rate (r): We'll assume ~4% (based on current long-term Treasury yields)

Estimated Option Prices (1-Year Expiry, Using Black-Scholes Model):

At 25% implied volatility (IV):

ATM (Strike = $32.25): ~$3.82

10% OTM (Strike = $35.50): ~$2.46

At 30% implied volatility (IV):

ATM (Strike = $32.25): ~$4.44

10% OTM (Strike = $35.50): ~$3.10

You're earning a 9.5% annual yield from owning silver, with the added potential for 10% price appreciation. Unlike stocks, silver can't go bankrupt or be involved in fraud—it's a solid asset that helps you sleep better at night.