Silver vs. Gold: Why the Gold-to-Silver Ratio Still Matters

In this episode of The Silver Show, we’ll break down the historical roots of the GSR, how investors use it today, and why many believe a GSR of 100:1 is not just unusual—but unsustainable. If you're trying to understand silver’s upside potential and whether now is the time to load up, this is the episode for you.

The Gold-to-Silver Ratio: What Is It, and Why Should You Care?

At its core, the gold-to-silver ratio measures how many ounces of silver are needed to buy one ounce of gold. If gold is $2,000 per ounce and silver is $20 per ounce, the GSR is 100:1. That tells us silver is relatively cheap compared to gold.

But this ratio isn’t just a curiosity—it’s a signal. For millennia, it has helped traders, governments, and everyday investors judge which metal might be undervalued. When the GSR is high, silver may be a bargain. When it's low, gold might offer better relative value.

A Brief History: From Kings to Central Banks

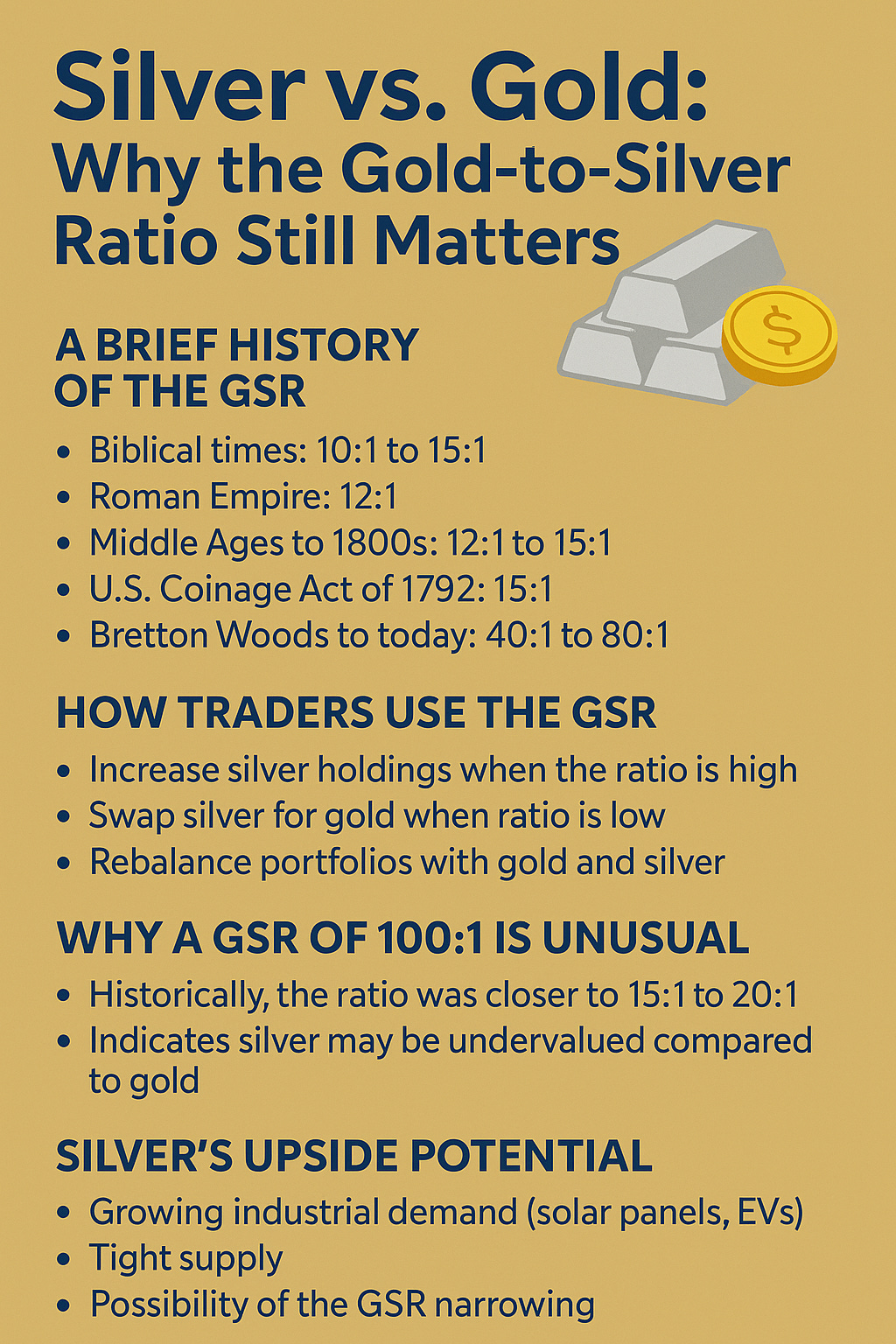

The GSR is not a modern invention. It has roots that stretch back over 2,500 years:

1. Biblical and Ancient Times

References to silver and gold as monetary metals go back to ancient Mesopotamia and the Bible. In Genesis 13:2, it says: “And Abram was very rich in cattle, in silver, and in gold.” In these early economies, both metals had intrinsic value and were exchanged according to a relatively fixed ratio—often around 10:1 to 15:1.

2. Roman Empire

During the Roman Empire, Emperor Augustus fixed the ratio at 12:1, and silver was widely used in daily commerce. Silver coins like the denarius circulated throughout the empire.

3. The Middle Ages to 1800s

Monarchs continued to set the GSR. In France, England, and Spain, it hovered between 12:1 and 15:1, reinforcing silver’s importance in the global economy. These were bimetallic systems—currencies backed by both metals, but pegged to each other via law.

4. The U.S. and the Coinage Act of 1792

The U.S. fixed the GSR at 15:1 in the Coinage Act of 1792. That lasted until silver was demonetized in 1873 during the “Crime of ’73,” which marked the beginning of the end for silver as a monetary standard in the U.S.

5. Bretton Woods and Beyond

After WWII, under the Bretton Woods system, gold was fixed to the U.S. dollar, but silver was left to float. This created an unofficial GSR which ballooned after the U.S. went off the gold standard in 1971. Since then, the ratio has been driven by market forces, often ranging between 40:1 and 80:1, with spikes as high as 120:1 during periods of market stress.

Why the 100:1 Ratio Feels So Off

Here’s where it gets interesting: for most of human history, the GSR hovered around 15:1 to 20:1. But in recent decades, it has regularly traded above 70:1, and during the COVID crash in March 2020, it reached an all-time high of over 120:1.

Why is this a red flag for many investors?

“A GSR over 100 means silver is historically dirt cheap,” says Bob from Si Iver. “It’s not just undervalued—it’s being ignored by the market.”

A high GSR often signals panic in the financial system. Investors flock to gold as the ultimate safe haven while abandoning silver, which—despite its precious status—is still viewed by many as more speculative due to its industrial uses.

But over time, the GSR tends to revert toward its historical average. Which leads many to ask: Is silver due for a massive comeback?

How Smart Investors Use the GSR to Time Moves

Traders and stackers have long used the GSR to determine which metal to buy—or when to swap one for the other. Here’s how:

1. Accumulation Strategy

When the GSR is high (above 80 or 90), many investors increase their silver holdings. Why? Because it means they can get more ounces of silver for every ounce of gold sold.

For example, if you owned 1 oz of gold when the GSR was 100:1, you could trade that for 100 oz of silver. If the GSR later dropped to 50:1, you could trade those 100 oz of silver back for 2 oz of gold—doubling your position.

2. Portfolio Rebalancing

Some long-term investors keep a fixed ratio of gold to silver in their portfolios—say, 50/50 by dollar value. When silver underperforms, they add more silver to rebalance. When it outperforms, they take profits.

“It’s a disciplined way to buy low and sell high—without needing a crystal ball,” Bob adds.

3. Hedging Against Inflation and Crisis

Gold and silver both serve as hedges against inflation, fiat currency devaluation, and geopolitical instability. But silver, being more volatile, can offer bigger upside during bull markets. Timing entry using the GSR can magnify those returns.

Silver’s Upside: Why Bulls Are Watching Closely

There’s a reason silver is called “poor man’s gold,” but lately, smart money is calling it “the undervalued gold.”

Here’s why:

1. Industrial Demand is Exploding

Silver isn’t just shiny—it’s useful. It’s a critical component in solar panels, electric vehicles, electronics, and even medical equipment. The green energy transition is already driving record silver demand.

The solar sector alone now consumes over 100 million ounces of silver annually—and that number is rising.

2. Supply Constraints

Unlike gold, silver is often a byproduct of mining for other metals like zinc, copper, and lead. That means even when silver demand surges, supply doesn’t necessarily respond quickly.

Couple that with five years of structural supply deficits, and you have a perfect storm of tight supply and rising demand.

3. Monetary Tailwinds

In times of monetary expansion and debt crises, silver tends to catch up fast. It has a long history of lagging gold in the early stages of a bull run—only to surge ahead later.

In the 1970s, silver jumped from under $2/oz to nearly $50/oz—outpacing gold’s gains during that decade’s inflationary spiral.

Forecasts: Will Silver Close the Gap?

So, will silver narrow the GSR and regain parity?

While no one can predict exact price movements, a growing number of analysts believe that a GSR of 100:1 or higher is unsustainable in the long term. Here’s why:

If gold remains around $2,300/oz and silver moves to a 50:1 ratio, silver would need to hit $46/oz.

A return to 40:1 would push silver toward $57.50/oz—more than 50% higher than current levels.

A reversion to the historical 20:1 would imply a silver price above $100/oz, which sounds extreme but not impossible in a monetary crisis or major commodity bull cycle.

“Silver doesn’t move often, but when it does, it moves fast,” says Bob. “It’s the sleeper asset of the precious metals world.”

Key Takeaways

The GSR is a time-tested tool—used by empires, central banks, and modern investors alike.

A high GSR favors silver—many see the current ratio above 80–100 as an anomaly driven by neglect, not fundamentals.

Smart investors use the GSR to rebalance portfolios and time asset swaps between gold and silver.

Silver’s industrial demand and supply constraints suggest it may outperform gold in the next commodity cycle.

A return to historical GSR levels could mean dramatic upside for silver—from $40 to even $100+ per ounce.

Stay Sharp, Stay Stacked

At The Silver Show, we don’t just follow silver—we stack it smartly. Watching the GSR can help you sharpen your instincts, protect your wealth, and maybe even outpace the gold bugs.

Whether you’re a first-time buyer or a seasoned metals investor, knowing where silver stands relative to gold is like having a compass in a stormy market.

If you’re looking to lock in silver prices now while the GSR is still in your favor, check out our layaway program at Si Iver. You can secure your silver with just 15% down—and ride the ratio all the way up.

Thanks for tuning in—stack smart, and we’ll see you next time.