Silver Weekly Outlook: Market Moves and Macro Drivers

During the week of May 25 to May 30, 2025, silver prices exhibited moderate fluctuations, reflecting a blend of industrial demand concerns and macroeconomic factors. The price per troy ounce ranged from $32.97 to $33.47, with a slight overall decline by week's end.

Daily Price Movements

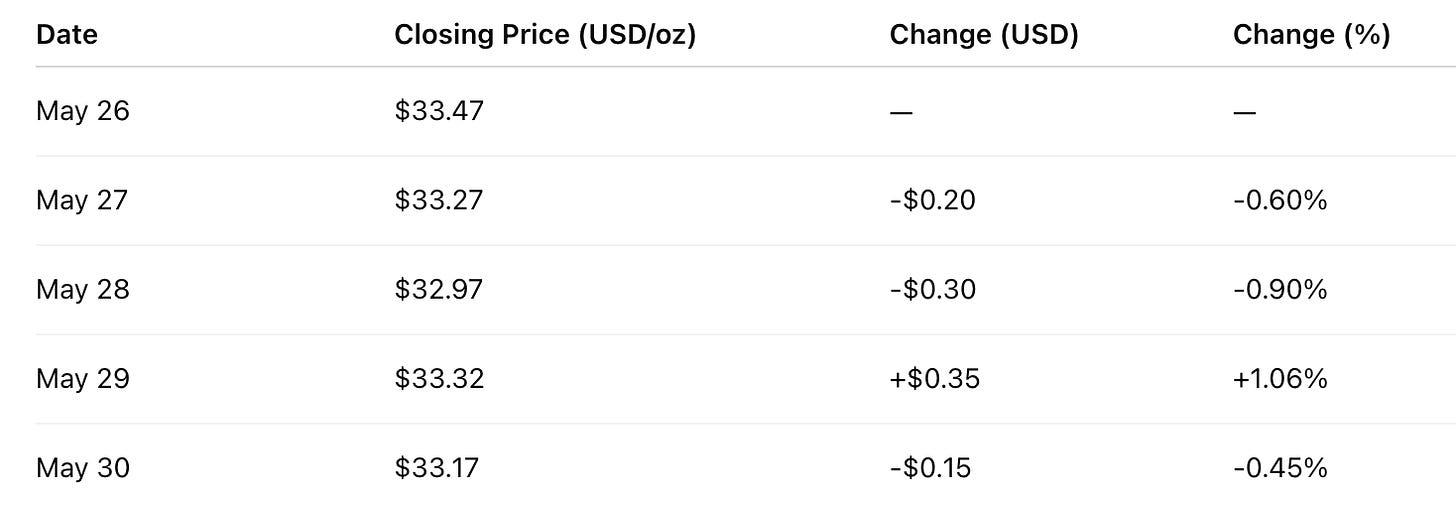

The following table summarizes the daily closing prices of silver for the specified week:

The week commenced with a high of $33.47 on May 26. Subsequent days saw a downward trend, reaching a low of $32.97 on May 28. A rebound occurred on May 29, with prices climbing to $33.32, before settling at $33.17 on May 30.

"Silver continues to be the most underappreciated asset in the precious metals space. With industrial demand surging and mine supply tightening, the fundamentals are setting up for a long-term bull cycle."

— David Downs, Senior Analyst, Si Iver Metals Research

Influencing Factors

Industrial Demand and Economic Indicators

Silver's dual role as both a precious and industrial metal makes it sensitive to manufacturing and technological sector demands. Recent concerns about industrial demand, particularly from the solar energy sector, have influenced price movements. Analysts note that silver's performance often correlates with industrial metals like copper, highlighting its economic sensitivity. (MarketWatch, Reuters)

Gold-Silver Ratio

The gold-silver ratio remained elevated around 100:1 during this period, suggesting that silver is undervalued relative to gold. Historically, this ratio averages around 68:1, indicating potential for silver price appreciation if the ratio reverts to mean levels. (MarketWatch)

Geopolitical and Monetary Policies

Global political developments, including trade policies and tariff decisions, have impacted investor confidence. Notably, decisions by political leaders, such as those related to tariffs, have influenced market dynamics, affecting both gold and silver prices.

Technical Analysis

Technically, silver found near-term support at $32.90, with resistance forming around $33.50. Momentum indicators such as the Relative Strength Index (RSI) suggest a period of consolidation. A breakout could occur if prices breach $33.60 next week.

Physical and ETF Demand

The iShares Silver Trust (SLV) saw modest inflows this week, indicating retail investor accumulation on price dips. Coin and bullion dealers also reported increased interest, particularly from long-term holders.

Industrial Use Deep-Dive

A major catalyst for silver demand remains the solar energy sector. China's $10 billion subsidy package for solar panel manufacturers is expected to boost silver consumption by 5% over the next year, according to Metals Focus.

Central Bank & Fed Watch

With the Federal Reserve signaling a potential rate cut in Q3, silver may benefit from a weakening U.S. dollar. Inflation expectations are also beginning to rise, making precious metals more attractive as hedges.

Global Mine Supply Watch

Global mine supply remains constrained. Labor disputes in Peru and declining production from Mexican mines are projected to reduce overall output by nearly 3% this year. This supply-side pressure supports the bullish case for silver.

Scenario Forecasts

Bullish Scenario: Silver climbs to $36/oz if industrial demand accelerates and Fed cuts rates.

Base Case: Prices remain range-bound around $34/oz through Q2.

Bearish Scenario: Economic contraction drags silver below $32/oz.

Strategy Tips for Investors

For long-term investors, dollar-cost averaging remains a sound strategy given current price levels. Some are also hedging silver positions with gold calls or using options to enhance returns during sideways movement.

Market Outlook

Analysts forecast that silver prices may experience upward momentum in the coming months, driven by:

Industrial Demand: Continued growth in sectors like solar energy is expected to bolster silver demand.

Monetary Policies: Potential interest rate cuts and a weaker U.S. dollar could make silver more attractive to investors. (Reuters)

Market Deficits: A sustained global deficit in silver supply may exert upward pressure on prices.

However, factors such as economic slowdowns or reduced industrial activity could temper these gains.

"What we're seeing isn’t just volatility—it’s recalibration. Silver is responding to its dual identity as both an industrial workhorse and a monetary hedge. That makes it uniquely positioned in today’s uncertain macro landscape."

— David Downs, Senior Analyst, Si Iver Metals Research

The week of May 25–30, 2025, showcased silver's sensitivity to a confluence of industrial demand, geopolitical events, and monetary policies. While short-term fluctuations were evident, the underlying fundamentals suggest potential for price appreciation in the medium to long term.