The Gold Rush Never Ends: Tales from the PCGS Dealer Show

There’s a certain electricity that hums through a PCGS Dealer Show — part trading floor, part treasure hunt, part therapy session for people who think in ounces and slabs.

You can always tell who’s been doing this a while. They walk in with rolling Pelican cases, two loupes hanging from their necks, and that calm, slightly caffeinated look that says, “I’ve already hedged twice before breakfast.”

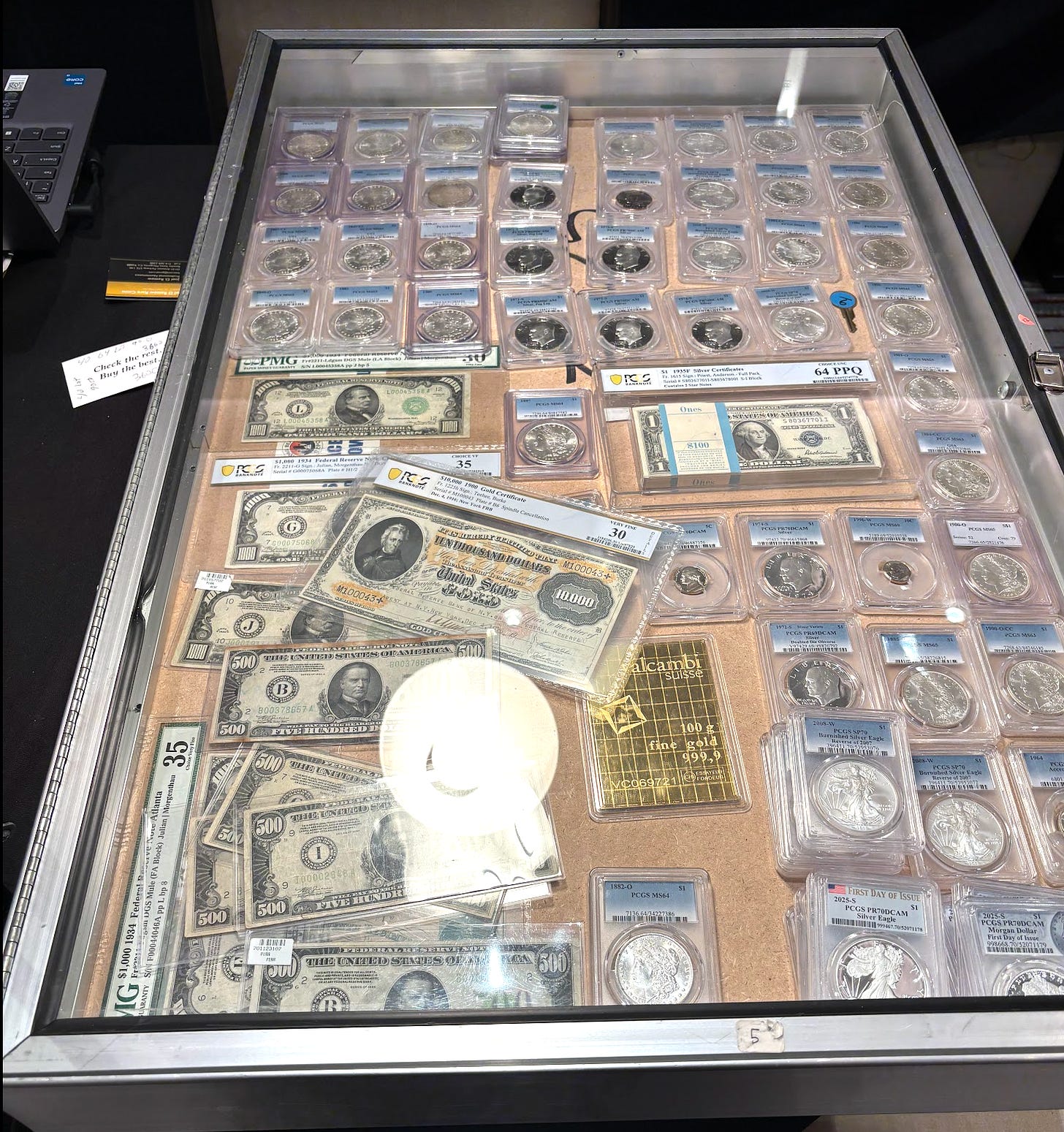

Every case on the floor was a museum in motion: stacks of Morgans, gleaming slabs of gold Saints, trays of proof Liberties that would make Fort Knox blush. The only thing brighter than the coins were the dealer price tags, updated so often you could hear the scratching of Sharpies across the room like cicadas.

When Silver Sneezes, Everyone Catches a Cold

Silver had just fallen about $7 in a matter of days, and you could feel the collective neck-crane toward the price tickers. Every conversation began with the same opener: “So, what are you quoting on 100-oz bars now?” It was like a first-date question, but with more anxiety and less small talk.

As one of Si Iver’s silver analysts, Rachel Denning, quipped between caffeine refills:

“Silver’s emotional right now — it’s like a teenager. It drops seven bucks and everyone panics, but two days later it’s back, pretending nothing happened.”

Rachel wasn’t wrong. The volatility had turned even the calmest dealers into day traders. A few joked they should install treadmills behind their tables, since they were constantly running from spot prices.

Gold: Too Hot to Handle

Meanwhile, gold was being, well, gold. At over $2,500 and sprinting higher some days, it had eaten most of the numismatic premium off the top. Dealers were pricing rare gold coins as “spot plus whatever keeps me from losing sleep.”

Another Si Iver veteran, Tom Ralston, summarized it best:

“At this point, gold’s like a toddler on espresso. You price it at breakfast, and by lunch it’s throwing crayons at you. The best you can do is laugh and keep your margins reasonable.”

He’s right — every time someone printed a new price label, the market moved just enough to make it wrong. A few booths gave up entirely and switched to dry-erase boards.

The Dance of the Dealers

For all the market chaos, the best part of the show was the camaraderie. Watching dealers negotiate is half psychology, half comedy. One moment it’s poker-faced silence; the next it’s laughter echoing across the aisle.

At one table, I overheard a classic exchange:

“How’d you get to that price?”

“I have no idea. You tell me what you think it’s worth.”

It’s a perfect encapsulation of the trade: everyone’s pretending to have a formula, but in truth, half the magic is intuition. There’s no Bloomberg terminal for luster and eye appeal — just experience and gut feel.

And the trust level was impressive. You’ll see one dealer walk across the room with a case containing $100,000 in coins to get a second opinion — no security guards, no contracts, just professional courtesy and reputation. In a world where people panic over a $12 Venmo charge, that kind of handshake economy is refreshing.

The Eternal “Raw vs. Slabbed” Debate

Naturally, I couldn’t resist asking opinions on raw versus graded coins. I heard every viewpoint under the sun, from “raw gives you upside” to “raw gives you ulcers.”

Tom from Si Iver had the most diplomatic take:

“Look, if you can spot a cleaned coin from across the table, go raw. If not, stick to PCGS, NGC, or ANACS — they’re like airbags for your wallet.”

Sound advice. With so much metal changing hands, and so many “honest” cleanings floating around, slabs are your safety net.

The Mood: Controlled Chaos with Good Humor

There’s something strangely grounding about seeing that much gold and silver being traded while the world outside debates interest rates, politics, and paper money. Inside the PCGS show, it’s pure capitalism in its shiniest form — you can feel the history in the metal and the hustle in the air.

Sure, a few dealers were gruff — but that’s part of the ecosystem. If one wasn’t thrilled to see you, five others were, ready to share a story about a 1917 Type 1 Standing Liberty they just scored or the time they bought a cleaned Peace dollar and somehow made a profit.

The running joke of the weekend was that PCGS should start giving out “Best Poker Face” awards. You’d see two dealers huddled over a coin, nodding silently, adjusting lamps, occasionally sighing like philosophers. Then one of them would shrug, and the deal would be done.

PCGS deserves real credit. These events are equal parts trade show, networking session, and group therapy for people who still believe in sound money. The logistics were smooth, the energy high, and the people — even in the middle of a wild market — genuinely fun to be around.

I walked out without needing to remortgage the house, which I consider a win. But more importantly, I left reminded of why I love this business: it’s equal parts intellect, intuition, and entertainment.

Couldn’t have said it better myself. See you all at the next show — and if gold moves another $200 before then, I’ll bring a pencil instead of a price sheet.