The Power of a Small Down Payment — How 15% on Silver Turned Into a 400% Return

When silver was sitting quietly around $32 an ounce, few people were paying attention. The headlines were about stocks, tech earnings, and crypto, not metal. But one Si Iver Coin Club member decided to do something unconventional — he bought silver on layaway.

Not ten ounces, not even a full bar upfront. Just 15% down — less than fifty dollars.

To most people, that’s an afterthought. But that small deposit turned into a story worth telling. Because when silver climbed from $32 to $50 an ounce, his patience and strategy paid off — literally — with a 400% return on the capital he initially put down.

The Math Behind the Metal

Let’s break that down.

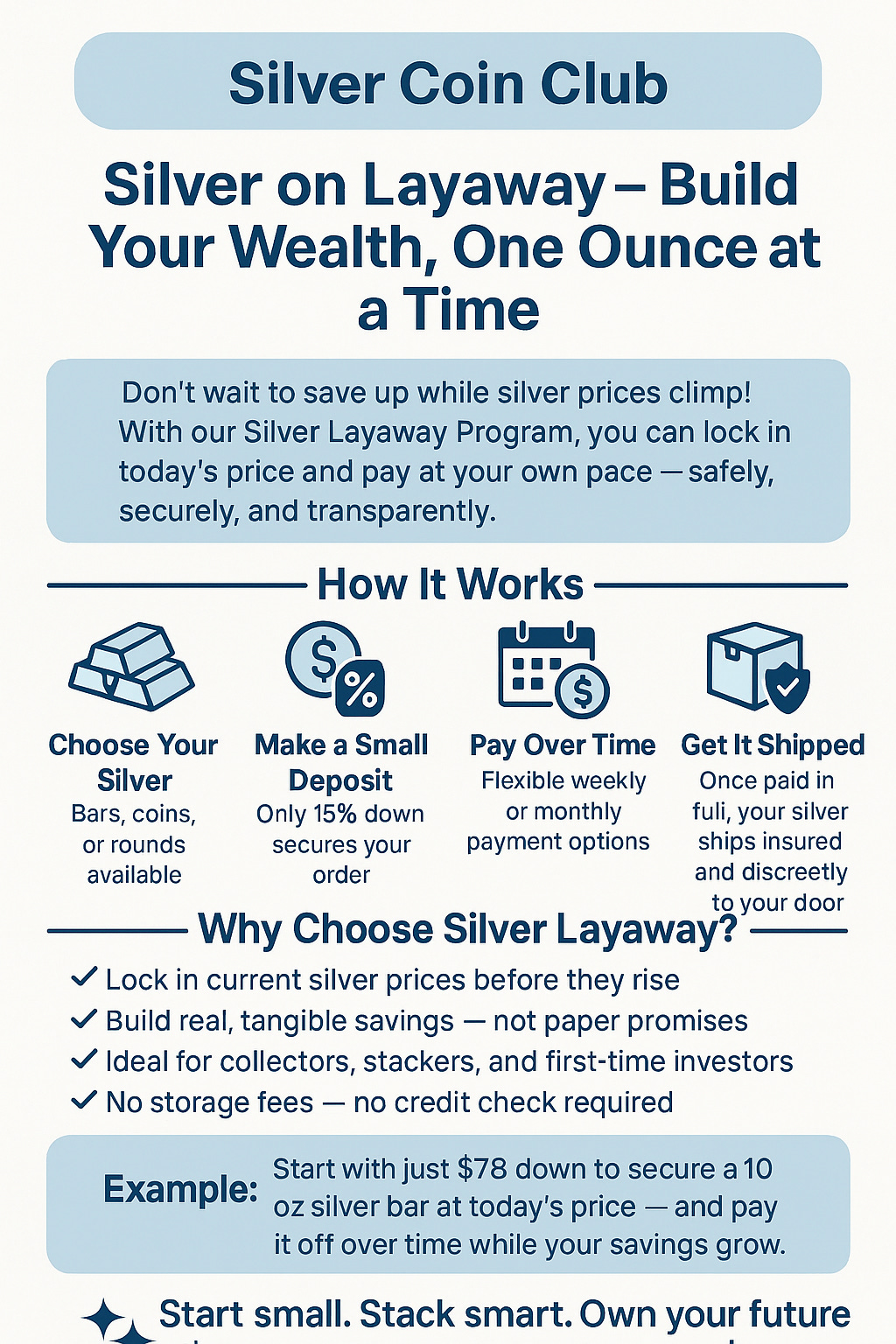

Ten ounces at $32.44 an ounce cost $324.40 total. Instead of paying it all upfront, our investor made a 15% deposit, or about $48.66. That secured the silver at that day’s price — effectively “locking in” ownership of the future appreciation.

Now, with silver sitting at $50 per ounce, those same ten ounces are worth $500. That’s a $175.60 increase, or a 60% rise in total value.

But here’s where it gets powerful: that $175 gain is on an initial outlay of just $48.66. That’s nearly a 400% return on the money actually invested.

That’s the quiet beauty of the layaway approach. It isn’t leverage in the traditional sense — there’s no credit risk, no margin calls, no interest charges. It’s simply a commitment to ownership over time, and a way for regular people to participate in wealth-building assets without having to come up with all the cash on day one.

Layaway as a Modern Savings Tool

The Si Iver Coin Club’s silver layaway model isn’t just for investors. It’s for savers, collectors, and anyone tired of watching prices rise while they wait to “have enough.”

For decades, layaway was associated with holiday shopping or big-ticket household items. But in an inflationary world, where fiat currencies lose purchasing power year after year, silver has become a store of value that transcends trends.

When you buy silver on layaway, you’re not gambling. You’re converting today’s small payments into tomorrow’s real assets. It’s like dollar-cost averaging, but with physical value — something you can hold, store, and pass down.

And as silver’s price movement this year has shown, a small foothold in a tangible asset can turn into an outsized result.

Start Small, Stack Smart

Our investor didn’t need to predict the market perfectly. He didn’t need complex algorithms or a brokerage account. He just needed a plan — and the discipline to commit early.

As he puts it:

“I didn’t buy silver because I thought it would double overnight. I bought it because I wanted to own something real, and I didn’t want to wait until it was too late.”

The result? That modest 15% down payment became a case study in how patience, discipline, and tangible value can outperform flashy speculation.

Silver layaway isn’t just about metal — it’s about mindset. It’s a reminder that you don’t need a fortune to start building one.

Start small. Stack smart. Own your future — one ounce at a time.